Step 3: Adjust as you go along.

Now you are tracking your spending. All is good, until one day, something unexpected happens. It might be that your parents are coming over so you need to buy some stuff, or maybe your car breaks down and needs sudden care. Or maybe even simpler, you under budget your groceries and didn't realise you are actually spending more than you thought you would be. This can happen quite often, especially during your first few months of budgeting, it takes time to fully understand how much your spending are, and EP is here to help you learn those.

When we talk about the budget, we often think of it as a fixed plan, that nothing can change once it's implemented. The truth is, especially for personal finance, it's not that easy. Sometimes we have unexpected expenses that might now and then, so we need to adapt to the situation.

EP's budgeting features are your friends.

The first thing we all need to understand, is that budget in personal finance are not fixed. They change as you go along, but at the same time, we should always try to make sure they change only when something unexpected is happening, changing your groceries budget every single month may indicate that you are either not budgeting enough, or you are over-budgeting, and that's a separate issue.

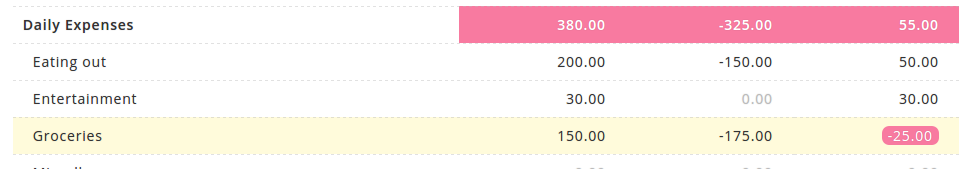

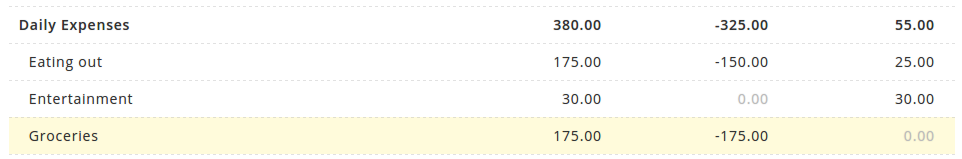

Now, it's okay to go on overspent, we can't predict the future after all. The good thing is, we usually don't overspend on all categories, it's a very rare thing to happen. That also means, that if we overspending on Groceries (for example), we might still have the budget on some other categories (probably Eating Out?). Now you can adjust the category on these 2 to cover each other.

In EP, you'll get a very clear indicator when you are overspending, or going over-budget. So once you see them, you can adjust them correctly to cover each other, in this scenario, let's cover the overspending with the available balance from Eating Out category.

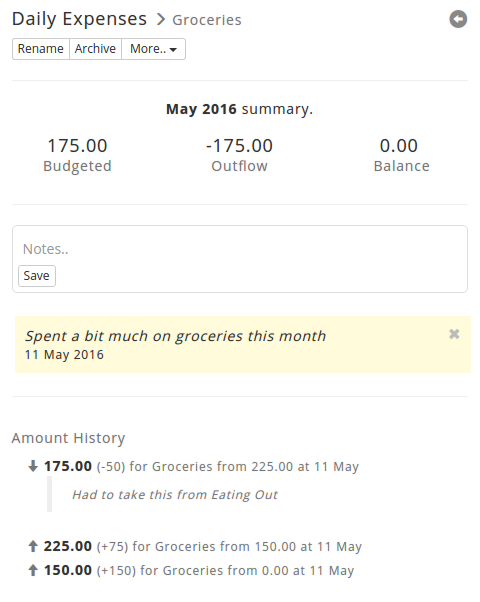

EP is all about budgeting, some of the things you can use when you are overspending is taking notes on what's happening, so you can review them later, and help you make the decision when you are budgeting in the future.

As an example, check out the category summary (left panel) after clicking the overspending category, you'll notice you have a note field, which allows you to take note about pretty much anything, and there's also the amount history section at the bottom, and that will show you how your budget for groceries is changing over time. What's more? You can click each of those and put a note on them.