Step 1: Budget for everything.

Welcome to EP! Budgeting has never been simpler. You only need to learn a couple thing or two and you're all set. In this page, we are going to take a look at the very first thing that makes budgeting work, by doing this, you'll have a crystal-clear view of your financial situation, priorities, plans and everything else. It makes your life so much peaceful when you know you have everything covered. This is the "planning" part of the whole budgeting universe, making sure you are prioritising the necessary expenses, and knowing how much money you have to enjoy the everyday lifestyle.

The objective of this lesson is to learn about: 1. Budgeting every dollar you have, down to the cents, and 2. Analysing your priorities. By then, you'll have all your money covered for every type of expenses – which by the way, it's how we came up with the name Everypocket, and you'll also know which part you can and can't compromise during the month.

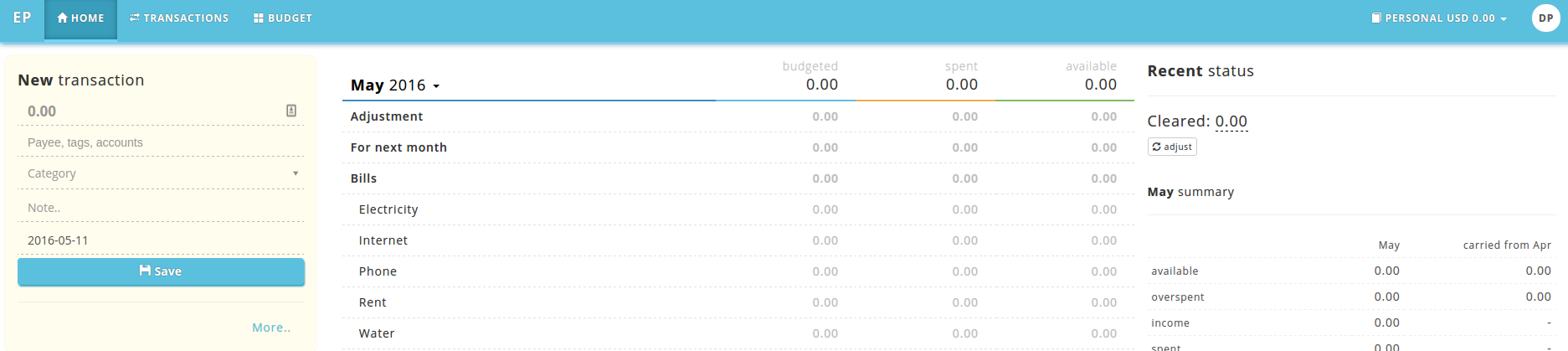

This is your workspace. We called it that way because we believe this is the part where you'll be spending most of your time while in EP. It is divided into 3 sections: transactions, budget, and summary. You can check out the complete guide page to learn more about what they do, but by looking at it, you can get some idea on what you can do on these sections.

Entering your first balance.

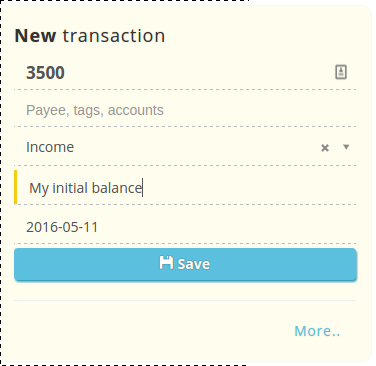

The very first thing we'll have to do is to tell EP our current balance. Click on the amount of the New Transaction form and enter your current balance, you can do this in 2 ways:

- Enter your total balance in your savings, checking and cash, by putting the amount in total, or use the plus "+" sign, e.g: 100+2000+1500

- Enter your balance one by one.

Either way set the category as income and click save, and you're all set!

Analysing your expense categories

After entering your first income, you'll notice in the budget section (the middle panel) that you have some amount to be budgeted. That's right, now it's time for planning. But first, look at the list of categories in the budget section.

These categories were created when you sign up to EP, we tried our best to collect some of the most common categories people usually have. However, it's good if you look through them and see if it fits your needs. If you don't need Car Loan, for example, you can click on it, and check out the More... button on the summary section (right panel), click on it and choose Delete.

Now you've cleaned up the things you don't need, it's time to check if you have some categories that're not there. Maybe student loans? Specific hobbies or saving for a vacation? Put them in! Click the month name on the budget section (at the top), and select New Category.

If you just created a new category, you'll also need to create the subcategory, this is a breakdown on what you are planning to budget for that category. We call them Master and Subcategory. To create one, click the category you just created and click Add sub from the summary section. Repeat this until you have categories you need.

Learning to prioritise

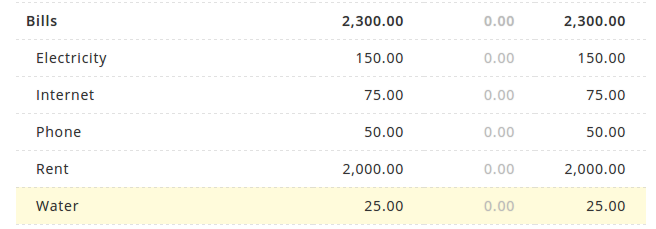

This is one of the most important things before we get into budgeting, look at your categories and see where your immediate expenses are, we are talking about the important expenses is, such as bills, rents, and some other basic necessities such as food and clothing.

But that's not all, you also need to have an emergency fund. What's that? Take a look at your basic expenses for a month, multiply that by 2, 3 or even six, the more the better. This is your emergency fund, it will keep you alive in the case you are out of a job. This is so important that it has become one of the pillars when establishing your financial situation. What's more is that it allows you stop living paycheck-to-paycheck. You don't have to worry about every end of the month about whether you can pay the bills on time.

Start budgeting

Now it's time to put the numbers down. Click on each of the categories and start allocating the budget for each one. Remember to prioritise your basic necessities first, including saving up for your emergency fund. Once done, take the remaining and put it in the entertainment-related categories. You might also have some goals in mind right now, maybe you want to go on vacation at the end of the year, or saving up for something you always wanted to have. Whatever that is, you can put them accordingly into their respective categories.

The rule for budgeting is simple, make sure you covers basic necessities, set up some savings, and enjoy the rest.